Omid Malekan

00:57

While I agree with the spirit of this rant, the conclusion is wrong. Permissioned blockchains have always been a fantasy.

They never go anywhere because they are the worst of all worlds: neither the consensus/cryptographic assurances of a permissionless chain nor the legal/regulatory protections of a TradFi database.

So yes, these institutions (DTCC, NYSE, SWIFT, etc) will never truly embrace DeFi. But those institutions (the millions more that are the customers, but also victims, of DTCC, NYSE, SWIFT, etc) will.

Not for any ideological reason, but because DeFi will save them money, offer better features, and never screw them in the way Wall Street does on the regular.

The revenues of crony-capitalist rent-seeking COBOL-loving institutions who foolishly think adding hash functions to a database somehow makes it better is DeFi's opportunity.

wassieloyer

02-01 15:14

Here’s the hard pill to swallow.

If your entire thesis is that TardFi regulations and adoption will give you DeFi summer again on alts again, you’re delusional.

Blackrock and JPM aren’t here to transact on or pump your DeFi / Infra bags. They will rebuild SWIFT on blockchain rails and create a closed network of participants once more.

I don’t know if you’ve realised but institutions adopting blockchain are defending their financial monopoly against a threat rather than going “awww the people are right we should really be transacting on transparent and immutable rails to embrace fair and open finance”.

The chains all the banks use will be built by Accenture or IBM financed from balance sheet by a coalition of US banks who then use their positions in the banking ecosystem to disseminate this network throughout the global banking system.

You and I won’t ever see a piece of the economics except when we indirectly pay the fees after we are unwittingly captured into the ecosystem we thought we escaped by some Jezebel “crypto founder” that deceives us into moving all our net worth into his wallet or stablecoin claiming backing from the powers that be in the hopes of an airdrop from suckling on the diseased teat.

The TardFi Trojan horse is in full swing and the only way to preserve our right to freely transact is to stand behind the DeFi builders that are truly cypherpunk aligned - the ones that made this industry grow from a joke experiment to a credible threat to the incumbents to start with, rather than bend the knee and suck the cock of Xerxes the moment he marches up with an army and offers you false promises.

Uplift yourself and stand for something because the existing powers will do everything to keep you on your knees.

arndxt

03:07

I’ve been yapping about Solana’s growth potential since last year.

@Mantle_Official did one of the biggest move in probably crypto history.

$MNT's move onto Solana is the most boss move ever.

the solana move is strategic

mantle super portal uses layerzero + OFT standard. maintains single native $MNT identity across ethereum and solana. not wrapped token. same asset different chain

what I'm watching on solana:

@byreal_io (bybit-incubated dex) hosting MNT-USDC pool. 96k $MNT incentives over 90 days. onchain yield live

@Bybit_Official alpha providing exchange-level liquidity. cedefi flywheel complete. onchain yield + centralized depth

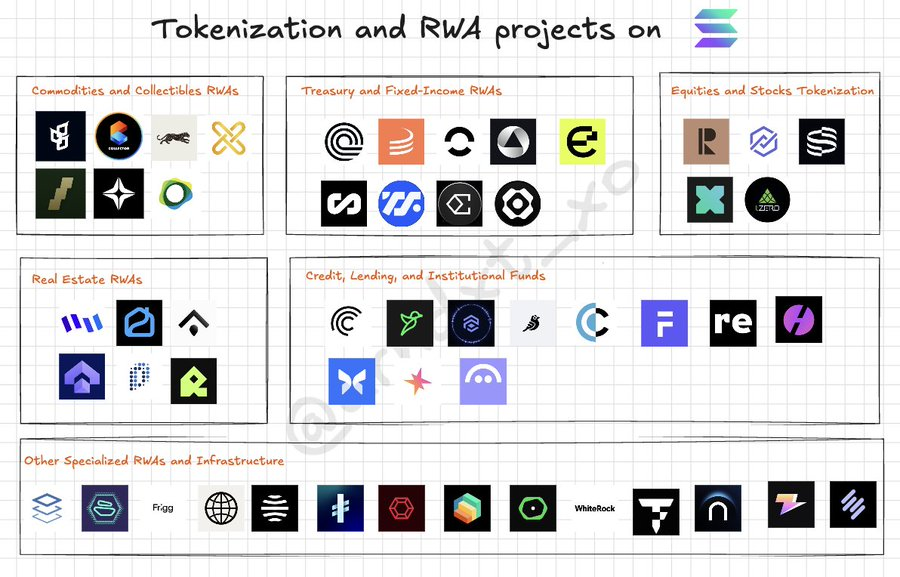

I'm positioning for RWA narrative 2026. mantle building rails between tradfi and crypto, which you can find it the list of tokenization project:

https://t.co/mK3L1Fpfc5

my thesis:

ethereum = institutional base.

solana = high-throughput defi.

bybit = centralized distribution

mantle positioning $MNT at intersection of all three.

unlocks:

- trading venues without fragmentation

- deeper protocol integration

- $MNT as collateral/payment/incentive across ecosystems

- this builds on mantle's @LayerZero_Core work and @HyperliquidX integration. they're connecting everything

what others see: token launched on new chain

what I see: unified liquidity layer emerging

capital doesn't want wrapped versions. wants native assets that move freely

I'm buying this infrastructure thesis. $MNT becoming actual cross-ecosystem primitive not just L2 token

watching TVL closely. bybit vault momentum suggests larger capital recognizing this

mantle executing while others announce. that's the signal

$MNT at support. infrastructure live. momentum building. I'm positioned

Haseeb >|<

01-31 18:35

With all respect to Star, this story is candidly ridiculous.

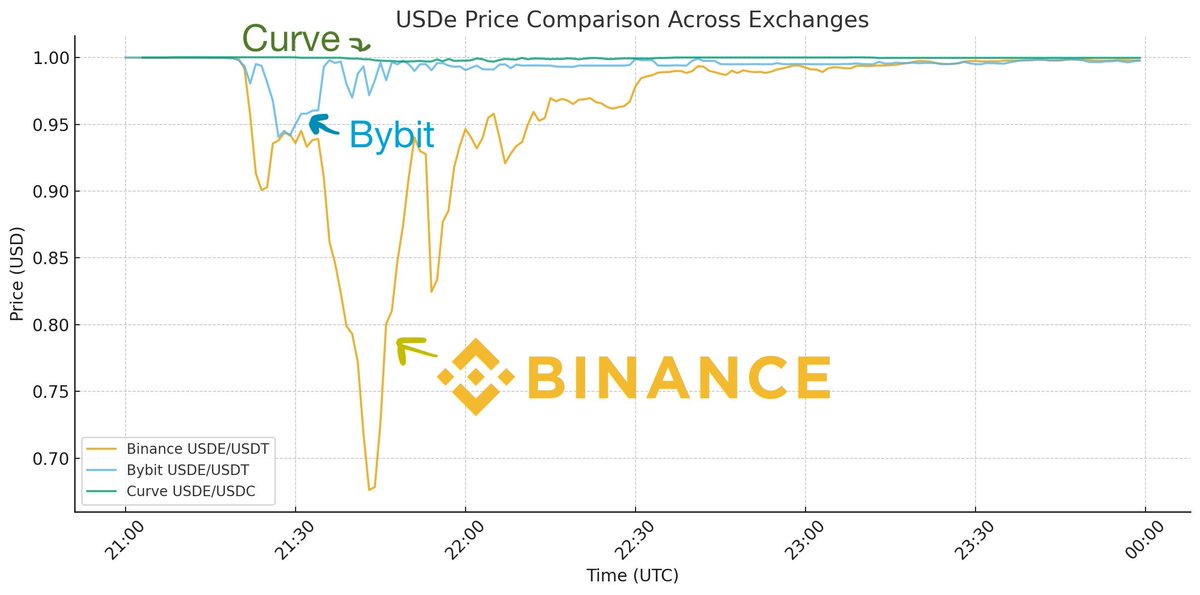

Star is trying to claim that the root cause of 10/10 was Binance creating an Ethena yield campaign, causing USDe to get overleveraged from traders looping it on Binance, which eventually unwound because of a small price move.

The problems with this story:

1) The timing of this story doesn't line up. BTC bottomed a full 30 minutes before USDe price was affected on Binance. So USDe clearly can't have *caused* the liquidation cascade. This is clearly misplacing cause and effect.

2) USDe price diverged ONLY on Binance, it did not diverge on other venues. But the liquidation spiral was happening everywhere. So if the USDe "depeg" did not propagate across the market, it can't explain how *every single exchange* saw huge wipeouts. This is very much unlike Terra, which depegged everywhere and caused the same damage across every venue.

So maybe you could hedge Star's argument by saying "OK, maybe Ethena didn't *cause* 10/10, but it amplified it." But even as an amplifier, USDe fails the test because it didn't propagate cross-exchange. We know what a good explanation of a crash looks like—Terra, 3AC, FTX, all had global balance sheet effects that were felt everywhere. USDe did not do that, it was a Binance order book isolated event.

3) This begs the question: why is Star "revealing" this now, months later? Star does not produce any new evidence for this theory that people didn't already know and analyze to death. All of the order book data has been public for 4+ months and suddenly he claims this? This feels more like Star is picking a fight with CZ and using this simple story as a pretext to make it sound like CZ was in on it, or caused 10/10 through his own irresponsibility.

Look, the reality is, there's no simple story explaining 10/10 that survives scrutiny. I don't have one either. If there was a simple story that could explain 10/10, there would already be widespread agreement about what caused it, like the agreement around the 3AC or FTX crashes.

The best story to explain 10/10 is, to my mind:

* Trump spooked markets with tariff threats on a Friday evening

* This caused markets to sell off dramatically because crypto was the only thing to trade

* Flurry of activity caused Binance APIs to go down, causing huge price dislocations and preventing market makers from balancing inventory across exchanges. This caused huge liquidations that could not get filled, but liquidation engines keep firing regardless, and all this got amplified by ADLs initiating everywhere and breaking hedges and risk management

* This caused MMs to get wiped out, and they were unable to pick up the pieces—MMs need APIs to rebalance inventory, and without MMs, there were no buyers of last resort for many alts. Retail was not going to step in on a chaotic Friday evening to buy stuff

* Crypto liquidation mechanisms are not designed to be self-stabilizing the way that TradFi mechanisms are (circuit breakers, etc.), crypto liquidations are designed purely to minimize insolvency risk

* Altcoin prices are extremely path dependent, and we ended up in a bad path

That's my story. It's not a very satisfying one, but neither is this "Binance + Ethena did it" story. A better root cause explanation is "APIs went down at the worst possible time," but that doesn't really sound so dastardly.

Where simple stories do not suffice, unfortunately you have to choose a complicated one. And I think this complicated story is the best one for what actually happened on 10/10. Thankfully, the history of crypto is a long series of these "bad things happened, and later the market recovered."

In the long run, I'm not worried that 10/10 permanently broke the market. Just that prices are path-dependent, retail + MMs got hurt bad on 10/10, and will need time to recover.

Bully

01-30 07:36

Mastercard beats. Lays off 4% of its workforce.

Amazon hugely profitable. Lays off 16,000.

Tech is the canary in the coal mine. Unemployment is probably as low as it will be the rest of our lives.

Ai is coming. Now. And it’s going to decimate corporate America’s workforce. https://t.co/6V8ADYbKUW

Ignas | DeFi

01-30 00:20

Tether is the new bank.

Similarly to banks, why would Tether give the yield if they can keep it?

We are just shifting power from one group of players to other corporations while users and decentralization suffers.

Yet, we will do well.

People will flee to Defi to earn yield.

We can see Kraken and Coinbase creating Cefi wrapper vaults on Defi.

This will generate fees to our beloved defi platforms, making their tokens valuable.

Whatever happens, we will do well.

Nico投资有道

01-30 10:34

早上醒来,看到美股市场开盘大跳水,一度暴跌了 2%,但盘中又被硬生生拉了回来。

本来我以为是宏观层面又出现了黑天鹅事件,但实际上的导火索却是微软财报暴雷。

在财报发布之后,微软股价一度暴跌了接近 13%,短时间内市值蒸发了 4300 亿美元,传导到了整个美股市场,引起恐慌抛售。

简单看了一下微软的财报,最关键的问题在于 Azure 云服务增长不够惊艳,低于市场预期,但 AI 资本支出却进一步上修,这是典型的投入与产出之间错配。

而隔壁 Meta 股价却暴涨超 10%,不仅仅是因为业绩和下一季度的指引大超预期,更多是在于 AI 强势赋能了 Meta 的广告业务,大幅提高了广告投放的精准度。

关于 Meta 的财报,晚些我会单独发推文和大家详聊。

这次财报季也印证了我之前反复提到的一个判断:

营收和利润本身并不是最重要的,更重要的是 AI 带来的营收和利润增长。

如果说 2025 是 AI 狂热投入的一年,那么 2026 就是 AI 兑现验证的一年。

2026 年资本市场希望看到 AI 叙事能够有实质性的落地,希望看到早期投入的资本支出,能够尽快创造出实际的业绩和现金流。

这也意味着,一旦某家公司持续在 AI 板块上砸钱,但营收利润没有得到明显的改善,市场会加大惩罚股价的力度。

这次微软和 Meta 的财报业绩和股价表现,就是最好的案例。

资本市场最终一定是逐利的,无论某个叙事或者赛道吹的有多么天花乱坠,最后还是得回归到核心的营收/利润/现金流。

ak0

01-29 21:01

There’s a knee-jerk argument against 24/7 tradfi perps:

“You can’t get liquidated by attackers exploiting a low-liquidity environment if the market is closed.”

This is superficially true. Thin weekend liquidity + aggressive actors + visible leverage = liquidation hunting risk.

But zooming out, the case for 24/7 is much stronger.

1) Price moves (and Trump) don’t respect office hours.

Big moves routinely happen on weekends.

If you can’t trade, you can’t de-risk.

So the liquidation still happens — just by Monday morning instead.

You didn’t avoid liquidation risk.

You deferred it.

2) Gapping risk is dangerous for the exchange, and for you.

Non-24/7 markets accumulate risk while closed.

When they reopen:

>price gaps discontinuously

>accounts are very negative

>exchange is forced into large, ugly ADLs

With 24/7 trading, the same unwind could’ve happened gradually, with continuous price discovery and less socialized loss.

3) Market share reality

If 24/7 trading is the end state (and it clearly is), then:

>non-24/7 venues will never be the most liquid

>spreads stay wider

l>iquidation slippage gets worse, not better

Liquidity attracts liquidity. You don’t get there by closing the doors.

4) Liquidation hunters are a solvable problem!

You can mitigate them with:

>light KYC / friction for predatory accounts

>better margining + mark price design

>concentration checks

Shutting the market is the bluntest possible tool — and not a very good one.

At @QFEX, we believe perps are the future of TradFi exposure, and continuous markets are inevitable.

Phyrex

01-30 09:50

Paul Atkins 在2026年1月29日CNBC《Squawk Box》节目中的阐述以及对养老金投资加密货币的预期。

1. 关于数字资产市场结构法案(Digital Asset Market Structure Bill)的进展

Atkins 强调国会正接近通过该法案,但未给出具体时间表或保证即将成为法律。他表示国会从未如此接近将两党市场结构立法送达特朗普总统的办公桌。反映了乐观但谨慎的态度,法案旨在为加密市场提供联邦框架。

在回应主持人关于是否能在年底前通过时,他说“我们拭目以待。正在与国会合作提供技术援助,确保立法合理并与其他法律协调。但我无法预测。”

这也表明 SEC在 提供支持,但最终取决于国会谈判。他提到法案随着立法逐步接近特朗普的办公桌,强调 SEC 和 CFTC 已准备好在通过后实施,但并未暗示“很快”。

2. SEC 与 CFTC 的合作及 Project Crypto

Atkins 与 CFTC 主席 Mike Selig 共同强调两机构合作,以实现特朗普政府的“使美国成为加密之都”的承诺。关于 Project Crypto ,他描述为“我们两机构一代人中最雄心勃勃的举措之一”。

3. 关于加密资产监管框架和创新

Atkins 指出即使没有立法,SEC也有足够权威推进,他提到计划推出创新豁免并希望在一个月左右推出。这旨在拥抱创新,避免过去对加密的阻力。

他还强调规则应适合目的。同时提及过去SEC已提供更多清晰度,如对Meme、稳定币、挖矿和质押的声明,以及经纪商和投资管理者的指导。

4. 关于退休计划(如401(k))中的加密货币投资

Atkins 表示是时候讨论允许加密进入退休计划,他指出许多美国人已间接暴露于加密资产,并强调需通过专业资产经理管理的401(k)等受监管产品来投资加密货币,但需有“护栏”保护投资者。如果Clarity Act(清晰法案,可能指市场结构法案的部分)能通过,这可能成为现实。

@bitget VIP,费率更低,福利更狠

梁岷Liam

01-28 09:55

2026年的感觉,像极了1970年代。

当年发生了什么?

- 布雷顿森林体系崩溃(美元脱钩黄金)

- 两次石油危机(能源成为武器)

- 美苏冷战升级(科技军备竞赛)

- 滞胀(经济增速下降+通胀高企)

那时候什么资产涨了?

黄金:1971年35美元 → 1980年850美元(24倍)

石油:1970年1.8美元 → 1980年约37美元(约20倍)

军工股:洛克希德、波音大涨

什么资产废了?

美元现金(购买力腰斩)

长期国债(利率暴涨,债券暴跌)

Route 2 FI

01-28 19:59

Starting to feel a bit more optimistic again for crypto.

The 50% increase for HYPE is a risk on, the same risk on we saw when $SOL was $20 in July 2023, and we all know what happened after SOL started running. Why am I so obsessed with the $HYPE move? The best coins tends to move first (SOL was that coin in 2023).

Include the facts that Gold is up massively and the dollar is nuking + Bitcoin hasn't moved yet.

Feels like the bottom for crypto.

Bill The Investor

01-29 09:17

历史上黄金每次史诗级暴涨后,几乎无一例外都发生了暴跌——幅度从30%到70%不等,区别只在于这是牛市中的大回调,还是牛市终结+长期熊市。

1971-1980:从35刀飙到850刀(23倍),1980年1月峰值后几天内暴跌超15%,一个月继续重挫,随后20年熊市最低251刀,跌幅65-70%。原因?沃尔克铁拳加息、通胀见顶、美元超级强势。

2001-2011:260刀→1920刀(7倍),2011年9月峰值后20天跌15.5%,2013年4月两天闪崩近30%,之后多年下行至1045刀,峰值后最大回撤46%。驱动逆转:美联储退QE、美元大涨、经济复苏、大宗熊市。

2025年:2700刀一路狂飙到4500-5100+(70-90%+),10月出现12年来最大单日暴跌5.3%-6.3%,年末仍有新高但波动如过山车。已经多次阶段性闪崩+快速V反,典型的大牛末期高波动、假突破、真派发特征。

核心铁律:

•暴涨末期(抛物线/疯牛阶段)必有剧烈回调,获利盘+杠杆爆仓+情绪过热。

•如果只是技术性回吐 → 20-40%后往往继续新高(牛市修正)。

•但如果宏观根本逆转(实际利率大幅回升 + 美元强势 + 通胀预期崩 + 风险偏好回升) → 很可能复制1980/2011,进入多年熊市,跌45-70%很正常。

现在位置:2026年初,黄金已完成极端加速,央行购金、地缘危机、财政赤字仍在支撑,但也堆积了巨量获利盘。走势高度类似1980年1月和2011年9月的顶部阶段——高波动、假新高、情绪极度亢奋。

一句话:历史上每一次黄金史诗暴涨后都暴跌过,你问有没有暴跌?答案是:有,而且往往很惨。

区别只在于,这次是“牛市中的又一次大洗”,还是“牛市终结、20年熊市开演”?

市场正在投票,你站哪边?站队前,先问问自己:如果实际利率重回正区间、美元再来一波超级周期,你的金价还能扛得住吗?

醒醒吧,历史不会骗人,但人性总爱自欺。#黄金 #投资 #避险资产

JackYi

01-28 21:00

Tether和Binance这类公司模式都是行业的抽水机,每年挣取百亿美金利润,在币圈早期不需要合规而野蛮生长成功。Tether作为一个非合规稳定币公司,一边在币圈挣取大量的利润,一边利用币圈利润疯狂的购入黄金。从投资角度来说它是成功的,从行业建设和尊重角度来看它是失败的。反而像USD1这种合规稳定币,把利润通过WLFI补贴给用户,同时不断买入ETH等行业资产,才是真正的行业Building。我希望CZ如果真心看好超级周期以及一姐看好比特币时代到来,应该把Binance部分利润买入BTC/ETH等,这才真正的言行合一,真正的Keep Building而更受尊重,当然也希望其他平台同跟上,只有行业牛市才能让大家更美好,而那些大空头才是行业真正的毒瘤。

Zak Folkman

01-27 05:33

The Real Stablecoin Revolution Is in Payments

Everyone knows stablecoins are being used for payments. That’s not news.

What’s actually interesting is how fast the infrastructure is maturing and how many real-world problems are getting solved right now. Not “someday.” Today.

And the legacy systems? They’re not built for the people who need it most.

The Problem We’re Solving

People in countries with unstable currencies need a safe place to store value. Their local banks are unreliable, inflation is destroying their purchasing power, and they have limited options.

Freelancers need to get paid across borders without hemorrhaging money to fees. International wire transfers take 3-5 days and cost $30-50 in fees. For someone earning $500 on a project, that’s brutal.

Remittances are the biggest opportunity. Someone working in the US sends money home to family in the Philippines, Nigeria, Latin America. Traditional services take 7-10% off the top. For billions of people, that’s money they can’t afford to lose.

But it’s not just individuals. Manufacturers are paying suppliers in other countries with stablecoins, cutting out days of settlement time and banking fees. Shipping companies are paying port fees in stablecoin so they don’t have to sit in harbor for 3-5 days waiting for a wire to clear. Time is money, and traditional banking infrastructure costs both.

What We’re Building at @worldlibertyfi

This is why we built USD1.

We’re creating stablecoin infrastructure that actually works for real people. Not just crypto traders. Not just institutions. Everyone.

USD1 is designed to be stable, accessible, and built on rails that make sense. Low fees. Fast settlement. Cross-border by default.

We’re building the payment infrastructure that should have existed from the start. USD1 transactions are free on @BNBCHAIN. Not “low cost.” Free. Because sending $20 shouldn’t cost anything in fees.

The vision is simple: your USD1 should work as easily as cash, but better. Instant. Global. Accessible to anyone with a phone.

Why This Actually Matters

This isn’t about speculation or getting rich quick. It’s about fixing fundamental problems with how money moves around the world.

International payments are broken. They’re slow, expensive, and exclude billions of people who don’t have access to traditional banking infrastructure.

What we’re building is parallel financial infrastructure that doesn’t care about borders or banking hours or whether you have a credit score. It just works.

The Reality Check

Look, I’m not going to pretend everything is solved. Regulation is complex and varies wildly by jurisdiction. We’re working through that.

On/off ramps between traditional finance and stablecoins still need work. We’re making it smoother, but there’s a long way to go.

And yes, the broader crypto space has trust issues because of bad actors and scams. We’re building USD1 with transparency and compliance at the core specifically to address that.

What People Miss

Crypto was supposed to be about payments from the beginning. Bitcoin’s whitepaper literally calls it “peer-to-peer electronic cash.”

The industry got distracted by trading and speculation. Which is fine - that created the infrastructure and capital we’re building on now.

But the payment use case? The remittance rails? That’s what will actually bring stablecoins to hundreds of millions of people.

Right now, millions of people already use stablecoins as their primary way to store and move money. Not because they’re crypto enthusiasts. Because it solves real problems better than their alternatives.

At WLFI, we’re building to make that 10x better. More stable. More accessible. More integrated into how people already move money.

That’s the opportunity. That’s what we’re building with USD1.

Nick Tomaino

01-27 23:52

$36B+ of crypto VC was raised in 2022

3 years later sentiment is low

Metals are outperforming coins, teams that raised hundreds of millions are giving up, DeFi and NFTs have underdelivered, nothing new has broken through to mainstream except Polymarket

Can’t think of a better time to build and invest if you believe in something

CM

01-28 13:27

ERC-8004 即将上线主网。这非常有可能是以太坊生态在DeFi之外找到的新角色。

每个Agent都有自己的链上身份。

声誉系统在链上记录服务历史和评价。

任何人/智能合约都能去验证它。

这些“资产”一旦产生,它的迁移成本会非常高,就像defi的流动性迁移成本一样,形成天然护城河。

新的AI验证场景,AI Agent行为验证,虽然ERC-8004没有直接写restaking,但留了验证请求/响应的标准接口,意味着这可以接入 $ETH 质押用于验证,EigenLayer之前也发布过在AI可验证性上的布局,ERC8004于AI验证,就像ERC20于token代币的关系。

这些对于以太坊来说,是结构性能力的扩展。

SΞA 🐸

01-27 09:26

在 𝕏 上,什么样的币圈内容受欢迎?我陆续有一些观察样本,总结为以下 8 类

情绪共鸣

让某个人群感受到共鸣,发言者成为一群人的嘴替。比如某段时间人人都骂 Vitalik、嘲讽 VC 是大韭菜、撸毛人对抗基金会的女巫、传播暴富焦虑也是击中了一堆人的情绪;比如我去年发豆瓣 20 周年那条 (https://t.co/Quz4g6Nfzr) 命中了很多人心里的豆瓣情怀,为豆瓣发展感到惋惜的心态。

工具教程

核心是满足了一群人的真实「需求」。比如怎么手把手参与某项目的测试网、怎么交互某个 DeFi 协议、科普或解读一个新的现象等。最近几个月,介绍实用 Vibe coding 工具、流行的 Prompt 贴子就是流量密码。

撒币空投

天上掉馅饼的事,不管真假先参与了再说。向粉丝提供抽奖的参与机会,一度是涨粉神器,但粉丝质量一般;一些项目方让用户留钱包地址,承认之后给空投等。

深度研报

关于某个具体项目、赛道的深度分析报告,动辄万字长文,有没有人看完不知道,反正看起来很专业。不过随着 AI 的 Deep Research 普及,这类报告的含金量缩水。

亏钱经历

所谓「看到朋友赚钱比自己亏钱还难受,看到朋友亏钱比自己赚钱还高兴」。当然了,真正赚到大钱的复盘 (可被验证的) 也会得到很多传播。真实的亏钱 / 赚钱经历,比成功学鸡汤更有用。

擦边抽象

擦边就不用解释了吧。

也有反向操作或者搞抽象的,比如王短鸟边哭边喝酒的视频。总之需要有底子 + 放得开,一般人复制不了。

当事内幕

基于自己独特职业和经历相关的「当事人说」,比如项目一手操盘经验、一笔投资背后的故事等。知乎早期很多这样的内容。这是其他人写不了的,有稀缺性。比如之前这篇写做市商的文章就传播很广 https://t.co/gbiI7CFhAN

冲突对立

主打一个看热闹不嫌事大,吵架 / 撕逼 / 八卦 / 维权类,不必多说。如果是两个群体利益对抗之争,不止于情绪,就会更火爆,比如代币社区大小写之争。

以上。

除了这种短期有爆发性的内容,长期还是要能找到自己擅长且能坚持的领域/主题,简单的事情重复做,让时间的杠杆价值体现出来。

Star

01-27 09:21

Gold solved the trust problem of the past.

Bitcoin solves the trust problem of the future.

While the world is still debating how to store gold,

the real future is already running on-chain.

Bitcoin is the foundation of the next generation of value.

In 2026, betting heavily on gold is essentially choosing the old system at a historical turning point.

Ray Dalio

01-27 01:05

Many people seem shocked by what’s happening, most recently in the Minneapolis and Greenland conflicts, though also in many other ways over the last year.

In my opinion, that’s because they don’t understand what’s going on with the breakdown of the post-World War II monetary, domestic political, and international political orders. This is happening in classic Big Cycle ways that have repeated throughout history and were laid out in detail in my book, Principles for Dealing With the Changing World Order, which I wrote about five years ago. In that book, I described how the Big Cycle unfolds in stages with clear characteristics, and I outlined the cause-and-effect relationships one can follow to identify where we are in the Big Cycle and what is likely to happen next.

With that perspective, it is clear to me that we are in Stage 5 (the pre-breakdown of the orders period) and on the brink of Stage 6 (the breaking down of the old orders). In my latest article, I review the developments that characterize Stages 5 and 6 and relate them to what is happening.

As always, I'd love to hear your thoughts.

https://t.co/BQzOZSYtL1

vitalik.eth

01-27 09:51

The scaling hierarchy in blockchains:

Computation > data > state

Computation is easier to scale than data. You can parallelize it, require the block builder to provide all kinds of "hints" for it, or just replace arbitrary amounts of it with a proof of it.

Data is in the middle. If an availability guarantee on data is required, then that guarantee is required, no way around it. But you _can_ split it up and erasure code it, a la PeerDAS. You can do graceful degradation for it: if a node only has 1/10 the data capacity of the other nodes, it can always produce blocks 1/10 the size.

State is the hardest. To guarantee the ability to verify even one transaction, you need the full state. If you replace the state with a tree and keep the root, you need the full state to be able to update that root. There _are_ ways to split it up, but they involve architecture changes, they are fundamentally not general-purpose.

Hence, if you can replace state with data (without introducing new forms of centralization), by default you should seriously consider it. And if you can replace data with computation (without introducing new forms of centralization), by default you should seriously consider it.

日历

2 月 2 日

数据请求中

copyright © 2022 - 2026 Foresight News